Venturing into the digital marketplace can be as thrilling as a treasure hunt.

We’re on the prowl for the best platforms to buy and sell online businesses, and the choices are abundant.

Whether we’re seasoned entrepreneurs or new to the game, finding the right spot to wheel and deal in the virtual world is key.

We’ve scoped out the top 8 sites that make trading online businesses a breeze.

Best Places To Buy And Sell Online Businesses

What Are Places To Buy And Sell Online Businesses?

If you’re looking to buy or sell an online business, there are several key platforms that can facilitate this process.

Flippa stands out as a popular marketplace, widely recognized for its extensive range of options, including websites, domains, and mobile apps. It’s particularly favored for its user-friendly interface and a diverse array of businesses on offer.

Another notable platform is Empire Flippers, renowned for its rigorous vetting process. It provides a more curated experience, catering to those interested in more established and profitable online businesses.

What Are Places To Buy And Sell Online Businesses?

When we jump into the digital landscape, finding the perfect spot to buy or sell an online business can feel like a treasure hunt.

With the right resources, this journey can lead us to success with ease and precision.

Some platforms specialize in web-based businesses whereas others offer a broader spectrum of services.

Each site has its unique features and community – essential components that contribute to our ideal transaction environment.

There’s a range of marketplaces that cater to various needs and preferences:

- Flippa – a leader for buying and selling small to medium online businesses.,

- Empire Flippers – focuses on vetted and profitable websites.,

- Business Broker Network – connects buyers with professional business brokers.,

- Exchange Marketplace – powered by Shopify and specializes in e-commerce stores.,

- FE International – provides professional M&A advisory services.,

- Sedo – renowned for trading domain names and websites.,

- Website Closers – deals with tech and internet companies..

It’s critical we pay attention to the transaction process and available support.

The best platforms offer secure escrow services and knowledgeable customer support to guide us through the sale or purchase.

Eventually, the value of these marketplaces lies in their ability to connect us to a vast network of potential buyers and sellers.

This connectivity ensures we have access to opportunities that align with our goals and investment strategies.

We must consider transaction fees and commission rates as they impact the overall cost of buying or selling an online business.

Transparency in these areas can save us from unwanted surprises down the line.

Accessibility and ease of use are non-negotiable factors in selecting a marketplace.

The more streamlined and user-friendly the platform, the quicker we can close deals and move forward with our entrepreneurial ventures.

Top Platforms For Online Business Sales and Purchases

Let’s take a look at some of the top Platforms for Online Business Sales and Purchases.

1. Flippa

Launching into the digital marketplace sphere, Flippa emerged as a pioneering platform for buying and selling online businesses.

It uniquely caters to a wide range of digital assets including websites, domain names, and mobile apps.

The versatility isn’t Flippa’s only selling point; it’s also renowned for its user-friendly interface.

That makes it straightforward for both beginners and seasoned investors to navigate the marketplace.

With plenty of listings across various niches, Flippa offers an eclectic mix of established enterprises and fresh startups.

We’ll find a treasure trove of online business opportunities ranging from e-commerce and content websites to SaaS companies.

The platform operates on an auction-based format allowing for competitive bidding.

This ensures that sellers get the best possible price while buyers can negotiate deals.

Flippa has developed a trust-centered environment through a robust vetting system.

Sellers must verify their traffic and revenue data which instills confidence in prospective buyers.

In terms of security, Flippa has the following features:

- An integrated escrow service – ensuring smooth, secure transactions,

- A private messaging system – facilitating clear communication between parties.

What’s more, Flippa provides extensive resources for both buyers and sellers to educate themselves.

The blog and learning center cover a wide array of subjects from due diligence to growth strategies.

These resources are invaluable for making informed decisions and navigating the marketplace successfully.

Overall, Flippa’s main goal is to streamline the process of buying and selling online businesses.

It offers an abundance of choices and valuable tools to assist users at every step.

Whether we’re looking to invest in a passive income stream or divest from a project, Flippa is a go-to destination in the online business marketplace.

2. Shopify Exchange

Shopify Exchange is a dedicated platform for buying and selling e-commerce stores hosted on the Shopify ecosystem.

It’s uniquely positioned to offer a seamless transfer of ownership with integrated functionality that’s hard to match.

The marketplace specializes in Shopify storefronts, providing a streamlined experience for all users.

Its straightforward interface allows sellers to list their stores quickly and for buyers to navigate various business opportunities with ease.

Listings on Shopify Exchange provide detailed analytics and performance metrics.

This transparency helps buyers make informed decisions and ensures sellers can showcase the true value of their businesses.

Here’s what sets Shopify Exchange apart:

- Direct integration with Shopify – ensuring accurate and up-to-date data,

- Pre-vetted listings – for added trust and security,

- Built-in messaging – facilitating communication between buyers and sellers.

We find the revenue and traffic data provided by Shopify Exchange to be particularly valuable.

Since it’s pulled directly from the seller’s Shopify account, it offers genuine insights into the store’s performance.

When it comes to pricing, Shopify Exchange offers clear guidelines.

Sellers are equipped with recommendations to help set a fair market price, fostering a competitive but reasonable environment for transactions.

Our experience also indicates the diversity of business options available on Shopify Exchange.

From startup stores to established brands, the platform covers a broad spectrum of online business opportunities.

With its focus on exclusivity to Shopify-hosted stores, the platform often attracts buyers who are familiar with the Shopify interface.

This can lead to a smoother transition post-purchase, as many operational hurdles are minimized.

The exchange process on Shopify Exchange is designed to be foolproof.

Every transaction is conducted through an escrow service, ensuring both parties are protected throughout the entire sale process.

3. Empire Flippers

When we’re talking about high-quality online businesses, Empire Flippers is a marketplace that frequently comes to mind.

They’ve built a solid reputation for connecting sophisticated buyers and sellers across a variety of niches.

Vetting is key with Empire Flippers – they scrutinize every listing ensuring only legitimate businesses make it to their platform.

This means we can trust the legitimacy of offerings when searching for an online business to buy.

Every listing comes with a comprehensive set of metrics that allows us to evaluate the health and potential of the online business.

Paramount factors like revenue, profit, traffic, and operations are clearly detailed, simplifying our decision-making process.

We appreciate how Empire Flippers places a strong focus on transparency throughout the sales process.

This is evident in their:

- Secure transaction protocols – Confidentiality management – Post-sale support Navigating Empire Flippers’ user-friendly interface couldn’t be easier, even for those of us new to buying and selling online businesses. With their personalized search tool, we can quickly filter through listings to find the perfect match for our needs..

For sellers, Empire Flippers provides a trusted platform to reach serious buyers willing to pay a premium for businesses that are in top shape.

They offer a valuator tool to assist sellers in correctly pricing their online enterprise.

Their service ecosystem includes a dedicated support team that helps us through every step – from listing to closing a deal.

With Empire Flippers, the support never feels like a cookie-cutter response but rather a tailored experience to meet our specific needs.

4. FE International

When looking for a professional advisory service for mid-market SaaS, e-commerce, and content businesses, FE International stands out.

This platform is renowned for executing deals with a tailored, boutique experience that emphasizes confidentiality and strategic advisement.

FE International prides itself on providing a personalized experience.

Their team delves deep into each business, ensuring buyers have detailed information at their disposal.

What sets FE International apart is their track record of success.

They have completed hundreds of millions in acquisitions since conception, boasting a 94.1% sale success rate.

With FE International:

- Clients get access to an exclusive network of pre-qualified investors,

- The team provides a thorough valuation analysis to position each business accurately in the marketplace.

Sellers benefit from strategic marketing plans designed to attract serious buyers.

Buyers enjoy a seamless acquisition process backed by expert advice.

FE International is more than just a marketplace – it’s a full-service advisory firm that helps clients through every step of the transaction.

With a global reach and offices in major financial cities, their expertise transcends borders.

5. SideProjectors

SideProjectors offers a unique angle on the marketplace scene – it’s the go-to hub for side projects, startup ventures, and even established online businesses.

It’s an ideal spot for technopreneurs searching for their next challenge or new passion projects.

What sets SideProjectors apart is its focus on creative and tech-driven initiatives.

This makes it a perfect fit for those who thrive on innovation and are looking for something less traditional than what’s available on other platforms.

The community here is teeming with developers, designers, and entrepreneurs all looking to either buy or sell their side projects or startups.

With the user-friendly interface, it’s easy to dive right into the offerings on SideProjectors.

Every listing is presented with clear details such as development status, revenue, traffic, and technology stack used.

We’re especially impressed with the transparency and the sense of community the site promotes – it encourages direct communication between buyers and sellers.

- For sellers, SideProjectors simplifies the listing process,

- Buyers benefit from the filter features which include sorting by price, age, and technology.

While SideProjectors might not see the volume of traffic that industry giants command, it makes up for it with a dedicated niche audience.

This audience is keen on the kind of innovative projects that don’t necessarily fit the mold of conventional online businesses.

We’ve found the platform refreshing for its emphasis on the startup and tech scene.

Many users report successful sales and acquisitions, which speaks to the effectiveness of SideProjectors as a specialized marketplace.

6. Digital Exits

When exploring options for buying or selling high-quality online businesses, Digital Exits stands out as a premier brokerage service.

They specialize in connecting sellers of profitable online companies with qualified buyers.

What sets Digital Exits apart is their focus on comprehensive valuations and strategic marketing.

They work tirelessly to ensure businesses are presented to the right audience, optimizing for the best possible sale outcomes.

Clients seeking personalized support will find Digital Exits offers extensive advisory services.

Their approach is tailored to the unique attributes of each business, reflecting their deep understanding of the online marketplace.

Key strengths of Digital Exits include –

- Thorough vetting process for businesses,

- Personalized exit strategy planning.

This platform is particularly suited for sellers aiming to command a higher price point.

Their meticulous attention to detail and strong buyer network translates into premium valuation and seamless transactions.

Understanding the significance of timing, Digital Exits provides market insights that align with current trends.

This enables both buyers and sellers to make informed decisions in a dynamic digital economy.

For those with established online businesses looking to exit, Digital Exits represents a strategic choice.

They bring a wealth of experience and a reputation for facilitating high-value deals.

What Kinds of Online Businesses Can You Buy And Sell?

When looking at marketplaces for online businesses, it’s vital to understand the variety of types available for purchase.

E-commerce stores, SaaS companies, content websites, and affiliate marketing businesses are high on the list for both buyers and sellers.

Each category has its own set of benefits and challenges that appeal to different entrepreneurial spirits.

For example, e-commerce platforms come with established client bases, while content websites offer a passive income through advertising and affiliate links.

SaaS companies stand out due to their recurring revenue models which can provide more stability compared to one-time sales businesses.

Also, their scalability is a massive draw for investors looking for substantial growth potential.

Affiliate marketing businesses are particularly intriguing for those who prefer not to handle physical products.

They leverage the power of online marketing to earn commissions by promoting other brands.

The online business market also encompasses a wider range of niche industries, such as:

- Online education platforms,

- Digital product marketplaces,

- Membership-based sites.

Buying and selling online businesses also include blogs, apps, and social media accounts influencing specific audiences.

Each presents a unique opportunity for digital entrepreneurship – structured for various levels of involvement and expertise.

With the rise of remote work and digital nomadism, online service businesses like consulting firms and digital marketing agencies are also traded frequently.

These enterprises cater to the growing number of companies seeking to streamline operations by outsourcing specialized tasks.

Whether it’s a turnkey operation or a startup with explosive growth, the right online business can be a game-changer.

It’s about matching the seller’s unique offering with the buyer’s vision and commitment.

1. Content Sites/Blogs

When we’re on the hunt for a new investment, content sites and blogs can be tantalizing opportunities.

They typically generate revenue through a variety of streams – ad sales, affiliate marketing, and digital product offerings.

A well-established content site can offer us a passive income stream with a loyal readership already in place.

These sites often rely on SEO and social media traction, which we can leverage for continued growth.

Content quality remains

We look for:

- Consistent, high-quality content,

- A strong niche with engaged audiences,

- Potential for growth and scalability.

One of our first steps in the acquisition process is to analyze traffic patterns and revenue reports.

This helps us understand the site’s earnings and the reliability of its income sources.

Investing in content sites and blogs offers us a chance to enter markets with lower barriers to entry.

Yet, they require a keen eye for detail and an understanding of content strategy.

Our strategy often involves improving on-site SEO and content to boost organic traffic.

We also explore options for increasing revenue per visitor.

By focusing on both the creative and analytical sides of content sites, we aim to optimize our investments.

We pay close attention to:

- User experience and design,

- Content curation and creation,

- SEO rankings and performance metrics.

Operational efficiencies are crucial – utilizing tools and outsourcing can help us manage our site effectively.

This can increase profitability while minimizing our hands-on time requirements.

2. Ecommerce Websites

Ecommerce websites offer a unique opportunity for entrepreneurs looking to enter the dynamic world of online sales.

These platforms allow us to connect with customers globally, providing a storefront that’s open 24/7.

Investing in an existing ecommerce site bypasses the challenges of building a customer base and developing a trusted brand from scratch.

We gain immediate access to established traffic and revenue streams, saving both time and resources.

When selecting an ecommerce website to purchase, we consider several key performance indicators:

- Annual revenue and net profit margins,

- Traffic sources and engagement rates,

- The diversity of the product line and supplier relationships,

- Customer reviews and the overall reputation of the brand.

Optimizing an ecommerce business often involves refining the user interface, improving product descriptions, and introducing new marketing strategies.

By leveraging data analytics, we can pinpoint areas for growth and expand our reach through targeted advertising campaigns.

It’s important to evaluate the scalability of ecommerce platforms.

Robust sites will have the infrastructure to manage increased sales volume without compromising on customer service or experience.

Finally, we look at the competitive landscape.

Understanding the strengths and weaknesses of competitors allows us to tailor our approach, ensuring that our ecommerce investment continues to thrive in a crowded marketplace.

3. SaaS Companies

SaaS, or Software as a Service, stands out as a highly sought-after niche in the online business marketplace.

This sector is booming, thanks to recurring revenue models and expansive growth potential.

Investing in a SaaS company means tapping into a market valued at $145.5 billion as of 2021.

Industry forecasts predict substantial growth, with cloud-based services becoming increasingly integral to modern business operations.

When shopping for a SaaS business, we prioritize a few key indicators that spell success:

- Profitable and scalable business models,

- A robust and loyal customer base,

- Clear and compelling value propositions.

We understand that solid SaaS companies are built on more than just software – they thrive on customer satisfaction and innovation.

Subscription models offer predictable revenue, but only if the service continually evolves to meet customer needs.

Entering the SaaS space requires a keen eye for technological trends and a firm grasp of the digital landscape.

We’re here to navigate these waters and identify opportunities that promise enduring value and competitive edge.

The acquisition of a SaaS business is a venture into the future of digital commerce.

With the right strategic approach, it represents a lucrative and sustainable investment.

4. Apps

The digital marketplace is not limited to websites and SaaS businesses – mobile apps have become a hot commodity as well.

With the proliferation of smartphones, the demand for versatile and innovative apps has surged, creating a lucrative market for buyers and sellers.

Buying an app can provide an entrant with a product that’s already been developed, bypassing the initial stages of finding programmers and going through the development cycle.

Apps with a stable user base and proven monetization strategies are particularly attractive investments.

When looking at apps for sale, we focus on:

- User engagement and retention rates,

- Monthly active users (MAU),

- Average revenue per user (ARPU),

- Compatibility with multiple devices and platforms..

Selling an app requires transparency about metrics and a clear explanation of how the app generates revenue.

Aspects like in-app purchases, advertising, and subscription models need to be presented in a detailed and straightforward manner.

Keeping up with trends is vital in the app market – today’s hit could be tomorrow’s memory.

We monitor shifting user preferences and emerging technologies to ensure the app remains relevant and competitive.

Monetization strategies for apps differ from other online businesses, revolving heavily around user experience and integrations.

We consider the scalability of these strategies when evaluating an app for purchase or preparing one for sale.

In the ever-evolving app landscape, staying informed is key.

This means we’re always learning new strategies to increase app visibility, such as App Store Optimization (ASO) and partnerships with influencers.

The growth potential for mobile apps is substantial, especially for those that tap into niche markets.

With our expertise, we steer clients toward apps that offer growth opportunities both in user base and revenue.

5. Domain Names

Domain names are more than just web addresses – they’re a digital commodity traded by savvy investors and businesses alike.

Their value can skyrocket with the right combination of keywords, brandability, and search engine optimization, making them an intriguing segment for online trade.

Buying and selling domain names is rooted in speculation, where the foresight to secure a catchy or trending name could yield substantial profits.

Investors often look for domain names with these traits:

- Short and memorable,

- .com extensions,

- Clear and brandable,

- Potential for commercial use.

We understand that domain sales sometimes fetch millions, but the market is also accessible for smaller investors.

The key is to research and identify domains that have the potential to become more valuable over time.

When venturing into domain flipping, we’re always on the lookout for emerging trends and industries.

Anticipating the next big tech innovation or pop culture phenomenon can lead to snatching up domain names that turn into goldmines.

We recognize that the right domain name can make or break an online business, underscoring its critical nature in the digital marketplace.

Hence, we prioritize finding domain marketplaces that offer a wide selection of names, allowing us to choose those with the highest growth potential.

Our strategy includes monitoring domain auction sites that feature expired or soon-to-be expired domain names.

This often offers us the opportunity to acquire domains at lower prices, which we can then develop or resell for a profit.

High-quality domain names serve as the foundation for building strong online brands.

We dedicate time to understanding the nuances of the domain marketplace to ensure we make informed purchasing decisions.

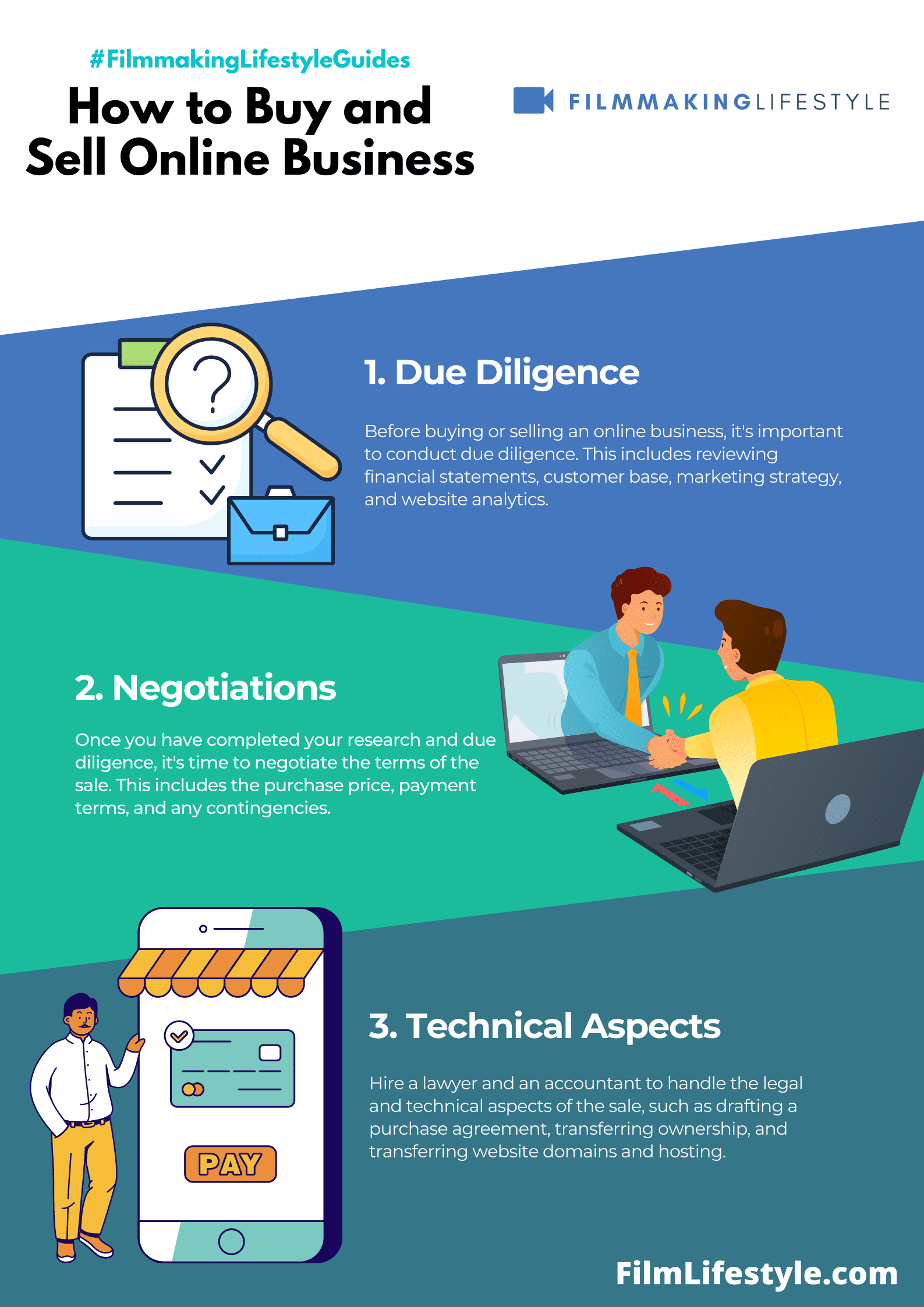

What Should You Look For When Purchasing An Online Business?

When venturing into the acquisition of an online business, it’s critical to thoroughly assess a range of factors before making an investment.

Identifying the potential for growth and scalability is

Verify the business’s financial health by examining profit and loss statements, tax returns, and balance sheets.

Solid financial records not only validate legitimacy but also lay bare the economic strengths and weaknesses of the business.

Pay close attention to traffic analytics and customer data.

These insights reveal the source, behavior, and engagement levels of the website’s audience – critical information for predicting future performance.

Consider the business’s online presence and reputation – key drivers of brand trust and customer loyalty.

Inspect customer reviews, social media interactions, and any public relations content to measure the company’s reputation in the digital space.

A strong, memorable domain name is a valuable asset for an online business.

Ascertain whether the current domain aligns with the brand and is conducive to search engine optimization.

The quality and reliability of the technical infrastructure should not be overlooked.

Verify that the website’s hosting environment, security measures, and back-end technology support a seamless user experience.

Examine the business model carefully –

- Does it have diverse revenue streams?,

- Is the customer base strong and recurrent?,

- Are the operating costs manageable and sustainable?.

Consider the legal aspects of the purchase.

Ensure due diligence is done on any intellectual property, trademarks, licensing agreements, and compliance with online business regulations.

Finally, explore the seller’s reason for selling.

Understanding their motivation can provide valuable insight into the business’s history and potential undisclosed issues.

How Do You Price Online Businesses?

When we’re assessing the value of an online business, there are specific metrics and factors that come into play.

Revenue, profit margins, and traffic are the keystones that typically determine a starting point for pricing.

Understanding the industry’s average multiples for earnings before interest, taxes, depreciation, and amortization (EBITDA) can give us a clearer picture.

Combined with a due diligence process, this helps us avoid overpaying for an underperforming asset.

We look closely at the revenue streams the business engages in – such as direct sales, affiliate marketing, or subscription models.

Each stream might carry its own risk profile and sustainability, impacting the overall valuation.

Analyzing the growth trends over time is as vital as examining the current financial snapshot.

A business with a steady uptrend in profits may command a higher price tag.

The competitive landscape is another aspect we can’t overlook.

We consider:

- The level of market saturation – The uniqueness of the product or service – The strength of the customer base.

Technological infrastructure is often a hidden gem in valuation.

State-of-the-art tech stacks can add significant value, while outdated systems might lead to future expenses.

Brand strength and domain authority are intangible assets that can markedly influence pricing.

Businesses with strong SEO rankings and social media presence can justify higher prices.

Finally, we factor in the reason for the sale.

A motivated seller due to retirement or lifestyle changes might be more flexible on price than one looking to cash in on a high-performing business.

Best Places To Buy & Sell Online Businesses For Sale – Frequently Asked Questions

When delving into the market of online businesses, a multitude of questions arise.

We aim to address some of the most frequent inquiries to guide you through this process.

What’s the best platform to find high-quality online businesses for sale?

The answer varies based on your investment strategy and the type of business you’re seeking.

Platforms like Flippa and Empire Flippers are celebrated for their vast listings and verified analytics.

How do I ensure a site is legitimate before making a purchase?

It’s critical to conduct due diligence:

- Review financial statements and traffic data,

- Request access to real-time analytics,

- Perform a background check on the business owner.

Is it possible to find niche-specific online businesses?

Absolutely – sites such as Shopify’s Exchange Marketplace specialize in e-commerce stores, while FE International focuses on SaaS and content websites.

Can I list my own online business for sale?

Yes, most platforms provide a user-friendly process for sellers:

- Sign up for an account,

- Provide detailed information about your business – Set a competitive price based on market analysis.

How are online businesses priced?

Online businesses are typically priced using various metrics – revenue, cash flow, and monthly traffic hold significant weight in the valuation.

What safeguards are in place for buyers and sellers?

Reputable marketplaces carry out escrow services and provide a secure transaction process to ensure both parties are protected.

Navigating the online marketplace requires a keen eye for detail.

Always remember to research and verify each potential opportunity thoroughly.

With the right approach and resources, buying or selling an online business can be a lucrative try.

Top Platforms for Online Business Sales and Purchases – Wrap Up

Venturing into the digital marketplace brings exciting opportunities and potential pitfalls.

Armed with the knowledge from our guide, you’re now equipped to navigate the terrain of online business transactions with confidence.

Remember, thorough research and due diligence are your best allies in ensuring a successful purchase or sale.

Whether you’re looking to acquire a niche-specific gem or aiming to list your online venture, the platforms we’ve discussed are your gateways to a world of possibilities.

Let’s embrace the journey of buying and selling online businesses, making informed decisions every step of the way.

Here’s to our success in the digital marketplace!