The Film Tax Credit Program is designed to provide financial assistance in the form of a tax credit for certain individuals and businesses involved with film production.

In order to qualify, you must be an individual who is not primarily engaged in the business of producing films, or a corporation that does not have more than 95% of its assets devoted to producing films.

You also need to be engaged in qualified production activities anytime during your taxable year.

FILM TAX CREDITS

What Are Film Tax Credits?

A film tax credit is a type of incentive offered by some governments to offset the cost of production for films.

The credits are generally given in exchange for employing domestic workers and using local resources, which can be an effective way to encourage regional economic development.

Film tax credits have been used as far back as 1918 and were originally created with the intention of enhancing employment opportunities in California’s struggling economy during World War I.

Film tax credits have become a game-changer in the movie industry, offering financial incentives that can make or break a production’s budget.

They’re a crucial factor in deciding where a film gets shot and can drive major economic benefits for the chosen locations.

We’ll jump into how these incentives work, why they’re so important for filmmakers and local economies, and the impact they’ve had on the industry.

Stay tuned as we unravel the complex world of film tax credits and their pivotal role in bringing our favorite stories to life.

How Film Tax Credits Work

Film tax credits are a type of financial incentive to encourage movie production in specific locations.

These incentives can be based on the percentage of a production’s qualified expenses, a process referred to as a rebate or refund.

Each state or country has its own set of qualifying expenditures.

These often include:

- Labor costs, including wages for cast and crew,

- Production costs such as set design and location fees,

- Post-production expenses like editing and sound design.

To receive these credits, filmmakers must apply through a specific process.

This usually involves submitting detailed budgets, production plans, and a script or project description.

The amount of the tax credit varies and is frequently the make-or-break detail for a production.

While some regions offer a modest 10-15%, others can provide as high as 30-40% in incentives.

Tax credits can be transferable or refundable.

Here’s what this means:

- Transferable – Producers can sell their tax credit to third parties if they cannot use the full amount themselves.

- Refundable – Means a production might get cash back if the tax incentives exceed the taxes owed.

Eligibility for film tax credits requires meeting minimum spend thresholds and hiring local talent.

This adds to the economic impact of the film or TV production within the region.

We understand the strategic financial planning behind utilizing film tax credits.

It’s a balancing act where the savings can channel additional funds into higher production values or additional projects.

Why Film Tax Credits Matter

Film tax credits are a pivotal component of the filmmaking process.

They not only reduce the cost of production but also encourage the employment of local crew and talent.

Our economies benefit significantly from these incentives.

They stimulate local businesses and can increase tourism when films showcase regional landmarks.

By reducing financial risk, tax credits make it easier for producers to greenlight new projects.

This leads to a more dynamic and diverse film industry.

For many filmmakers, the decision on where to shoot hinges on the availability of these credits.

Areas with more generous incentives often see a surge in film activity.

Tax credits can greatly impact the narrative of a film’s financing.

They are a critical part of securing investors and managing budgets.

Investing in film production has a multiplier effect on the economy:

- Creates jobs and boosts the local job market,

- Encourages associated businesses like hotels and restaurants,

- Enhances the cultural reputation of the region.

With a strategic approach to film tax credits, productions can maximize their economic impact.

It’s an intricate game of financial chess that benefits the players and the board alike.

Economic Impact Of Film Tax Credits

The catalytic effect that film tax credits have on local economies cannot be overstated.

By encouraging film productions to shoot in certain locales, these credits have a ripple effect that goes far beyond the immediate film crew and cast.

Local employment skyrockets as productions hire from within the community, ranging from technical staff to extras.

What’s more, this job creation extends to adjacent industries like catering, hospitality, and construction, which are essential to accommodate film crews.

The numbers speak volumes – for every dollar spent on film tax incentives, there’s a significant return to the state or region’s economy.

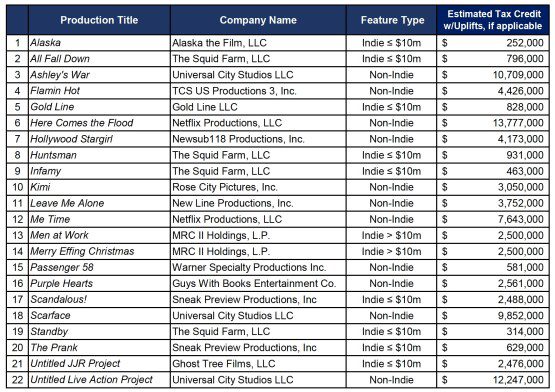

Let’s dissect this with some data:

| For Every Dollar of Film Tax Credit | Return to the Economy |

|---|---|

| $1 | Up to $1.50 |

These incentives also nurture a cycle of success for the local film industry.

A thriving local industry means:

- More competitive skill sets among workers,

- Better infrastructure for future projects,

- Enhanced reputation as a filmmaking hub.

Meanwhile, hotels, restaurants, and retailers experience increased patronage thanks to the influx of film crews and tourists drawn by film-related sites.

Iconic locations in films such as The Dark Knight and Forrest Gump have become tourist hotspots years after the movies premiered.

Filmmaking is an investment – in stories, in technology, in talent.

But it’s also an investment that pays dividends to local economies and cultural landscapes.

With film tax credits, we can ensure that this investment continues to benefit communities and filmmakers alike.

Success Stories: Film Tax Credits In Action

Georgia has emerged as a prime example of film tax credits’ success.

Films like The Hunger Games franchise and shows like Stranger Things have brought staggering economic benefits to the state.

Louisiana’s surge in film production resulted from strategic use of tax incentives, contributing to the state’s nickname “Hollywood South.

” Blockbusters such as 12 Years a Slave underscore the significant impact these credits have on local economies.

In New Mexico, the growth of the film industry is linked to a robust tax rebate program.

Productions like Breaking Bad and its subsequent tourism illustrate the sustained economic growth from such investments.

Ohio’s motion picture tax credit has generated vast returns, creating thousands of jobs and boosting state revenue.

- Economic Increase – millions of dollars in local spending – Job Creation – thousands of new positions across various sectors.

Britain’s approach to film tax relief has solidified its position in the international film industry.

The production of films such as the Harry Potter series reveals the vast potential of well-structured tax incentives.

These examples demonstrate that effective film tax credits can transform a region’s economy, creating a ripple effect that encourages further investment, diversifies the workforce, and enriches the cultural landscape.

Challenges And Controversies Surrounding Film Tax Credits

While film tax credits have fueled the growth of local economies, they are not without their challenges and controversies.

Critics argue these incentives can sometimes lead to an unsustainable arms race among states seeking to attract film productions.

State governments are pressured to continually increase incentives, potentially creating a superficial economy largely dependent on external investments.

Unintended consequences often emerge from the implementation of film tax credits.

One issue is the displacement of traditional industries.

We may see sectors suffer as resources get redirected toward the more glamorous film industry.

This shift can lead to questions about long-term economic stability.

also, there’s ongoing debate over the cost versus benefits of film tax incentives.

Some believe that the rewards are overstated and that the tax credits cost more than the jobs and revenue they generate.

These critics claim that the actual return on investment (ROI) is not as high as portrayed.

Studies show varied results –

- Economic boosts that are hard to quantify,

- Job creation numbers that may not reflect permanent employment,

- Tourism increases that can’t be solely attributed to film tax credits.

Transparency and accountability have also become pressing issues.

We’ve learned that not all states disclose the specifics of their deals or the precise impact on their economies.

Without this information, it’s difficult to gauge the true effectiveness of the tax credits.

Incentive abuse is an additional concern.

Filmmakers sometimes exploit these tax benefits without contributing significantly to the local economy.

Besides, there is the worry of companies improperly claiming credits, which prompts calls for stricter regulations and oversight.

eventually, while film tax credits can and do lead to economic gains, the surrounding complexities require careful consideration and management.

Ensuring that these programs are cost-effective, sustainable, and equitable is crucial for their continued success and acceptance.

Film Tax Credits – Wrap Up

We’ve navigated the complexities of film tax credits and their impact on both the entertainment industry and local economies.

It’s clear that while these incentives can be powerful tools for growth, they require strategic oversight to avoid pitfalls.

As we move forward, it’s essential to balance the allure of Hollywood with the fiscal responsibility states must uphold.

Let’s continue the conversation and work toward solutions that benefit all stakeholders in the film tax credit debate.

Frequently Asked Questions

What Are The Main Challenges Of Film Tax Credits?

Film tax credits face challenges such as potentially sparking an unsustainable competition among states, displacing other industries, and questions regarding their true return on investment.

What Are The Controversies Surrounding Film Tax Credits?

The controversies include the debate over cost versus benefit efficacy, lack of transparency and accountability in some states, and the risk of incentive abuse by filmmakers.

How Do Film Tax Credits Impact Traditional Industries?

Film tax credits can lead to the displacement of traditional industries as states focus on attracting film productions, which can sometimes overshadow local business needs.

Why Is Transparency An Issue In Film Tax Credits?

Transparency is an issue because not all states fully disclose the specifics of their incentive deals or the exact impact on their economies, making it difficult to assess the real benefits.

What Does The Article Suggest About The Management Of Film Tax Credits?

The article suggests that film tax credits require careful consideration and management to ensure they are effective, accepted, and that they truly contribute to the local economy without undue negative implications.

Matt Crawford

Related posts

6 Comments

Leave a Reply Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Solid article!

Cheers, James.

Needed this!

Our pleasure, Hammett.

Great info on film tax credits.

Thanks, Guido.