People frequently wonder, “Who finances a film?” Filmmaking is an expensive business, with budgets ranging from $1 million to $400 million.

The answer is that film financing can come from a variety of sources, including studios, distributors, production houses, and even private investors.

This article examines the complexities of filmmaking and how financing plays a significant role.

Many various investors, including Marvel Studios, Disney, and Converse, helped make the most recent Hollywood blockbuster, Black Panther, a reality.

Hollywood has been operating since the early 1900s, and making a film takes a lot of money.

movie financing

What Is Movie Financing?

Movie financing is the process of raising money to produce a movie.

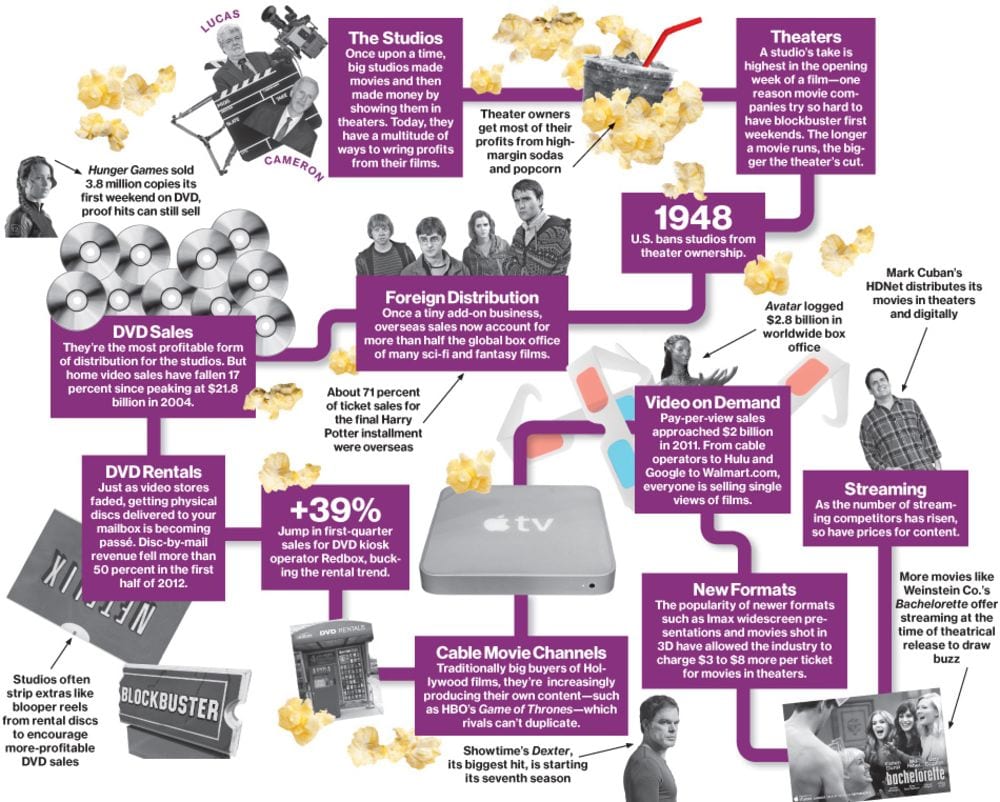

The most common way to raise money for movies – and the one that has been used by Hollywood since its inception – is through film studios.

In this model, the studio provides funding in exchange for distribution rights (meaning they get to sell it).

Navigating the complex world of movie financing can be as dramatic as the films themselves.

It’s a crucial step that turns a screenplay into a visual masterpiece gracing the silver screen.

We’ll explore the intricate dance of securing funds, from independent films to blockbuster budgets.

Stay tuned as we jump into the financial backbone that supports the magic of cinema.

Methods Of Movie Financing

Diving deep into the intricate world of movie financing, we’re met with a variety of options each unique to the project’s needs.

Here, we break down the common routes producers take to secure the vital funds.

Equity Financing involves investors providing capital in exchange for ownership.

Films like The Blair Witch Project were brought to life through this risk-reward model.

Debt Financing means borrowing money to fund the film.

It’s a loan that needs repaying, often with interest, a tactic used even in the biggest of blockbusters.

Production companies may also opt for Pre-Sales.

It involves selling the film’s rights in advance to secure funding, a popular choice amongst Indie Filmmakers.

We often hear about Tax Incentives and Rebates.

Filmmakers seek locations offering financial advantages, lowering overall production costs.

Mad Max: Fury Road benefited greatly from such incentives in Namibia and Australia.

Crowdfunding has emerged as a game changer – platforms like Kickstarter enable filmmakers to raise funds directly from the audience.

Veronica Mars saw massive success with this approach.

Government grants and subsidies are sometimes overlooked, yet they play a critical role.

Countries around the world offer these incentives to encourage local film production.

finally, we have Film Studios and Production Companies themselves.

Giants like Universal often have funds allocated for new projects, especially for in-house productions.

Venturing into these financing methods, we acknowledge that each has its own set of complexities and benefits.

Integrating one or multiple strategies often leads to the weaving of the financial safety net necessary for the silver screen magic to unfold.

Independent Film Financing

When diving into the realm of independent film financing, it’s essential to understand that creativity is not limited to the script or the screen.

Often, Indie Filmmakers must be equally innovative when it comes to funding their projects.

Unlike major studio productions, independent films typically don’t have the luxury of large budgets or guaranteed distribution deals.

Securing funding for an Indie Film can be challenging, but there are several avenues that can be explored.

Equity investment is one such path where investors contribute funds for a stake in the film’s potential profits.

This method requires filmmakers to have a compelling pitch and a clear vision for their project’s financial return.

Crowdfunding platforms like Kickstarter and Indiegogo have revolutionized Indie Film financing.

They allow filmmakers to connect directly with their audience to raise capital.

By offering various rewards and engaging potential viewers throughout the production process, we can create a community of supporters invested in the film’s success.

Pre-sales of distribution rights can also provide crucial funding for independent films.

This involves selling the film’s rights in different territories before the movie is completed.

While this can secure initial funding, we must ensure the film meets the contractual obligations to avoid legal and financial complications.

Here’s what we should consider when approaching independent film financing:

- Crafting a strong business plan to attract investors,

- Building an attractive rewards system for crowdfunding backers,

- Negotiating favorable pre-sale agreements to aid with upfront costs.

Film grants and subsidies offered by government bodies and arts organizations can be a golden opportunity.

They’re usually awarded based on the project’s cultural value or the filmmaker’s vision and don’t require repayment, making them highly sought after in the indie scene.

Investing personal funds can be a risky yet common strategy for Indie Filmmakers.

This approach demands careful budgeting and a willingness to bear the financial brunt if the film doesn’t turn a profit.

Even though the risks, it embodies the independent spirit – the drive to create art no matter the obstacles.

Studio Financing

Studio financing represents a vastly different landscape when it comes to movie production.

Unlike independent filmmaking where funds are often scraped together from a multitude of sources, studio projects usually have access to larger, more reliable funding.

Major film studios have established financing mechanisms that cater to a broad range of production needs.

They can support everything from small-scale projects to blockbuster releases.

Studios benefit from having financial reserves and various funding channels at their disposal.

They leverage these resources to ensure consistent content creation that meets market demands.

Their methods include:

- Slate financing,

- Strategic partnerships,

- Internal funding reserves.

Studios also have the advantage of accessing revenue from a diverse portfolio, which can be re-invested into new productions.

Projects under studio financing often feature well-known talent and have marketing budgets that match.

This serves as an attractive package for investors looking for less risky ventures.

The financial power of studios allows them to Use complex financial instruments such as production loans, gap financing, and tax incentives.

They have the infrastructure to maximize these tools effectively.

Studios are adept at pre-selling distribution rights as well, often on a much larger scale compared to independent films.

These sales provide substantial upfront capital and help to mitigate some of the risks involved in film production.

Given the resources at their disposal, studios can control larger segments of the production and distribution pipeline.

This includes budget allocation, marketing, and often the creative direction of a project.

It’s a top-down financing system that contrasts sharply with the grassroots nature of independent film financing.

Studios are able to navigate through the riskier aspects of filmmaking with a sense of security backed by corporate strategies and extensive funding options.

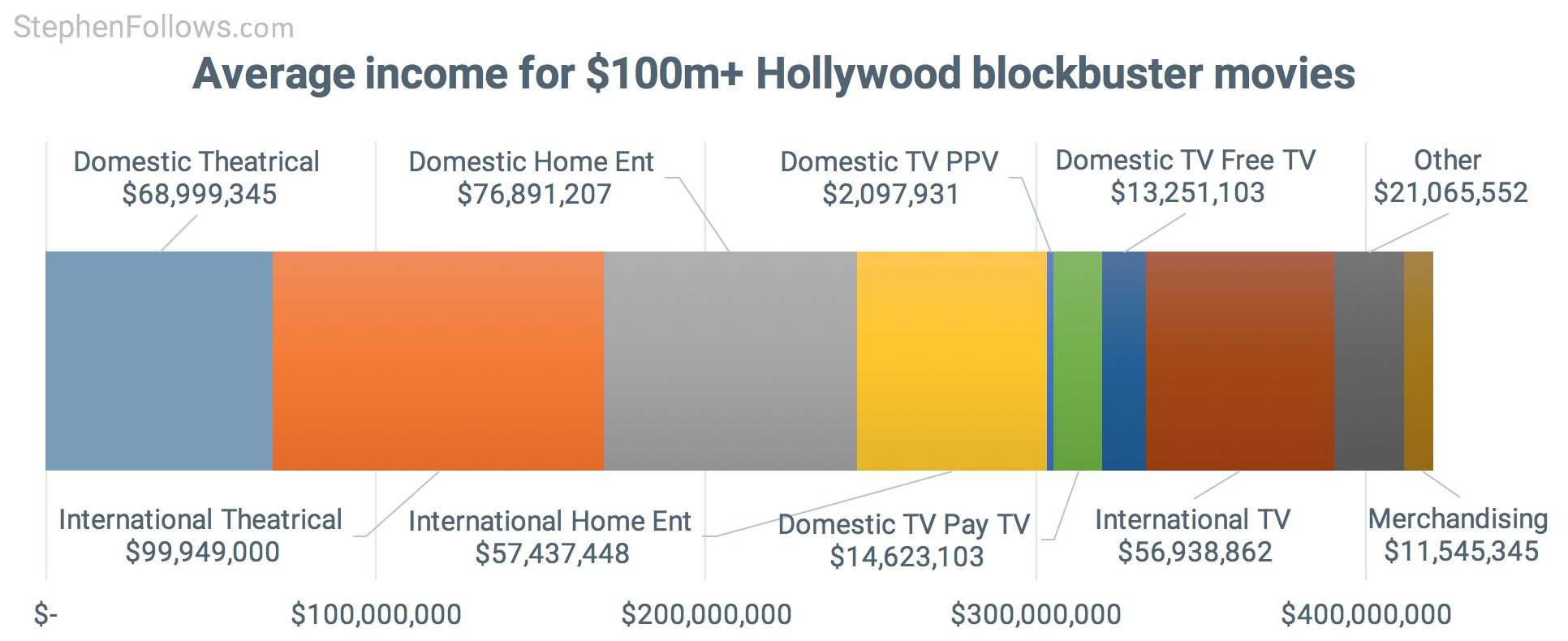

Funding For Blockbuster Films

When we jump into blockbuster films, the scale of financing increases substantially.

Blockbuster projects often involve budgets that soar well into the hundreds of millions, necessitating a more complex funding web.

These films rely on a combination of sources to meet their substantial financial needs, creating a funding tapestry that’s as intricate as it is robust.

Studios typically form the financial backbone for blockbusters like The Avengers or Titanic.

With deep pockets and strategic interests in ensuring their heavy investments pay off, they employ a multi-tiered approach to funding.

These funds can include:

- Internal cash reserves,

- Strategic partnerships with other studios or financial entities,

- Slate financing deals that spread the risk across a range of films.

The marketing prowess of a studio is a linchpin in the success of a high-budget film.

Marketing campaigns can almost match or, in some cases, exceed the production budget itself.

This highlights an understanding that the final cost balloons far beyond the raw production expense.

Hedge funds and private equity investors also play a considerable role in funding blockbuster movies.

Their involvement is often tied to the expectation of films’ potential to generate massive returns.

This type of investment is driven by a mix of data analytics and a dash of Hollywood glamour that still holds a strong allure for financiers.

Tax incentives and rebates are an essential part of the financial equation.

Countries and states entice producers with a range of benefits, influencing where these film behemoths are shot.

Producers savvy in leveraging these incentives can significantly offset the cost, easing the burden on fundraising efforts.

While blockbuster financing is a world away from independent film production, both require a solid grasp of the financial landscape to ensure their projects come to fruition.

The keys to success hinge on strategic planning, understanding the market, and crafting a compelling narrative – both onscreen and in the proposal to investors.

Challenges In Movie Financing

Facing the realities of movie financing, we often encounter a variety of hurdles that can make or break a project.

Some of the most persistent challenges include the following.

- Lack of access to capital – many filmmakers find it tough to secure the necessary funds.

- Competitive markets – it’s a race against countless others vying for a limited pool of resources.

We recognize that the financial risk associated with filmmaking can be a major deterrent for investors.

The inherent unpredictability of a film’s success makes them wary, leading to a cautious approach in fund allocation.

The reliance on market trends and audience preferences adds another layer of difficulty.

Films must resonate with viewers to see a return on investment, creating pressure to conform to current demands.

Intellectual property rights pose yet another challenge.

Securing these rights is often expensive and time-consuming, and without them, a film can be stalled indefinitely.

- Intellectual property complexities – from securing rights to navigating legalities.

- Budget overruns – unexpectedly high costs can derail even the most meticulously planned projects.

We understand the importance of maintaining a balance between creative vision and financial viability.

Navigating the delicate terrain of investors’ interests and the integrity of the cinematic piece is an art in itself.

Effective networking is the key to unlocking many doors in the film industry.

Building relationships with financiers, producers, and distributors is as crucial as any other aspect of the filmmaking process.

- Relationship building – it’s about who you know and how well you connect.

- Financial knowledge – a solid grasp of investment strategies and market trends can set a filmmaker apart.

Even though these challenges, we’re motivated by the potential to craft stories that captivate and inspire.

Our resolve to overcome these financing hurdles is fueled by our passion for the art of filmmaking.

Movie Financing – Wrap Up

Navigating the world of independent film financing is no small feat, yet it’s clear that with the right mix of passion and know-how, filmmakers can overcome the hurdles.

We’ve seen that building a strong network and possessing a solid understanding of the financial landscape are key to bringing creative visions to life.

Let’s not forget that at the heart of these efforts is the drive to tell stories that resonate and inspire.

Armed with determination and the insights we’ve shared, independent filmmakers are better equipped to turn their cinematic dreams into reality.

Frequently Asked Questions

What Are Common Challenges In Independent Film Financing?

Independent filmmakers often face challenges such as limited access to capital, intense competition, dealing with intellectual property issues, and managing budget overruns.

Why Is Networking Important In Film Financing?

Effective networking is crucial because it allows filmmakers to connect with potential investors, industry professionals, and collaborators who can provide funding or resources for their projects.

How Do Intellectual Property Complexities Affect Film Financing?

Intellectual property complexities can make it difficult to secure funding as they involve navigating legal rights and ensuring proper clearances, which can be daunting for independent filmmakers who may lack the necessary legal expertise.

What Motivates Filmmakers Despite The Financial Hurdles?

Independent filmmakers are typically driven by a strong passion for storytelling and the desire to create compelling, inspiring cinema that resonates with audiences, outweighing the financial challenges they encounter.

Matt Crawford

Related posts

1 Comment

Leave a Reply Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Great Post!